🎯 New! Clean your undeliverable emails, including catch-alls. Start with 5,000 free email verification credits →

The success of a product or service launch relies on your go-to-market strategy. A strong go-to-market strategy allows sales and marketing teams to reach their target audience with information that is relevant and attractive to them, enticing them to engage, enquire, and buy. With the aim of the GTM strategy to capture as many conversions as possible with minimal customer acquisition cost, it is essential that every marketing and sales activity is precisely targeted to have optimum impact. How can sales and marketing teams create a winning go-to-market plan? It all starts with the ICP.

Regardless of whether you are reaching a new market with an existing product, testing a new product in a new market, or launching a new product or service to an existing market, the starting point for a go-to-market strategy usually looks something like this:

While every step of the GTM strategy is important, the success of any strategy depends on its foundations. In this case, a strong GTM strategy relies on understanding your TAM/SAM/SOM and, in doing so, identifying your ideal customer profile (ICP). After all, if you aren’t specific about who you are reaching out to, it will be almost impossible to make sure that your message resonates with your target customers.

By creating a well crafted go-to-market strategy that fits well within your business model, you will win more opportunities, make the most of your resources and gain the competitive advantage. An effective GTM strategy should be designed to help every department improve their performance, helping sales teams to manage the sales cycle effectively and guide customers through the buying process. When done well, your go-to-market strategy will do more than help you with an impactful product launch; it will help you to create – and leverage – strong market demand and help you to continue to reach business objectives further down the line.

In defining your ICP as a central element of your marketing plan, you are not just discovering who your ideal customer is; you are taking a deep dive into your product or service and its value to potential customers. If you get this process right, you will optimize your chances of reaching the right prospects at the right time, as well as developing a deeper insight into your product and its potential.

We know that getting your ICP right can help your go-to-market strategy, but what about if you get it wrong? The impact could mean more than simply missed opportunities: if you are targeting the wrong audience, you are wasting valuable resources and negatively impacting your ROI. On the other hand, if you target and reach the right audience with the wrong message, you risk weakening your GTM strategy and missing valuable conversion opportunities; it’s imperative that sales teams and marketing teams stay aligned so the right targets get the right messages.

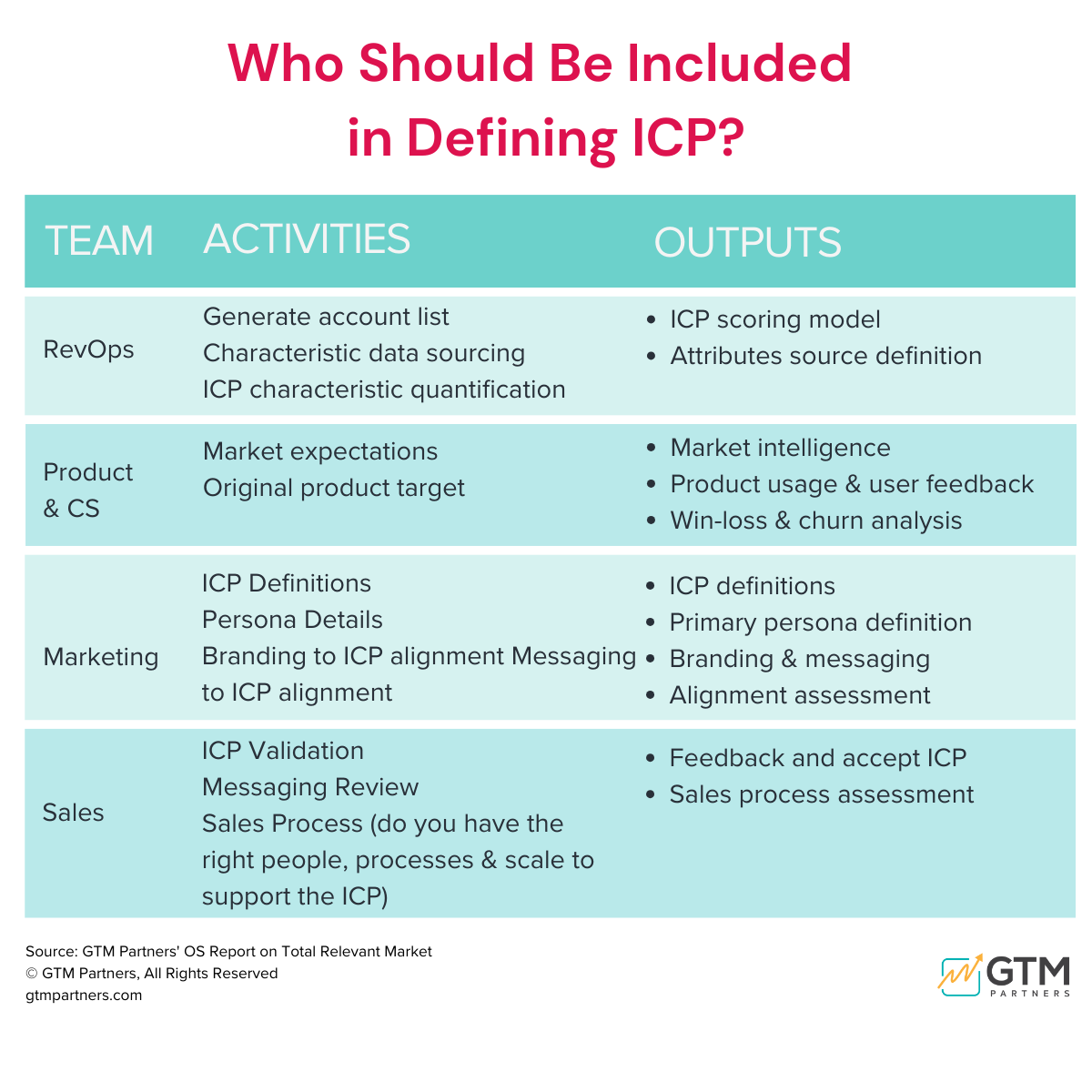

Organization-wide impact doesn’t just require organization-wide understanding, but organization-wide buy-in. Imagine that the sales team doesn’t quite understand the exact problem and impact of the proposed solution created by the product team, and the marketing team understands the problem and solution, and knows who the ICP is as defined by the product team, but doesn’t agree with the profile so goes off in a different direction. In this scenario where your product, sales, marketing and customer support teams are each targeting a different audience – even if that difference is subtle, your message will become more diluted at every stage of the not just the customer journey, but product journey.

Making the process of defining your company’s ICP an organization-wide exercise encourages every team, from the C-suite downwards, to agree on and deliver the same, cohesive message to your target audience. As a result, your marketing strategy will be finely honed to reach your target market, giving you the competitive advantage over go-to-market strategies that have undefined or misaligned ICPs.

The task of defining your ICP may seem a huge one, but it is very possible that a lot of the data that you need is at your fingertips.

In the first instance, it can pay to take a look at your existing customer data and pick out commonalities within them. You can make this exercise as broad or granular as you want to go; that depends on your needs and the specifics of your product or service. At the very least, you should categorize your existing customer data by firmographics, demographics and buying habits.

Once you have your broader customer data, you want to see which ones of those fit your ideal profile. Look for the ones with the highest ACV or LTV, highest potential for future growth, highest customer health ratings, and highest customer retention rate. You aren’t just looking for potential customers: you are looking for customers who are ready and willing to buy, and who are likely to stay with you for the long game. When looking for your best customers, it is also a good idea to look at customer acquisition cost; not just how much income you generate from that customer, but what you had to invest to get a return.

At RevenueBase you will hear us talk a lot about segmentation. Segmentation allows you to take your ICP and further refine it so that you can initiate sharp, targeted marketing and sales activities that are designed to meet your decision makers where they are at. Segmentation is a balancing game: too niche and you could limit your reach; too broad and you risk missing the mark with your messaging. It pays to take a little time to look at your different segments, highlight their differences and how your sales and marketing approaches may differ for each, then prioritize. Prioritization could be based on potential return on investment, ease of reach, previous and anticipated success rates, as well as data from similar business models and product launch activities.

While nailing down your ICP is important, it’s critical to create personalized messaging that will attract the attention of your audience. Whether you are reaching out to existing customers or aiming to reach a new customer base, your sales and marketing efforts are likely to fall flat if they don’t resonate with your target audience. In fact, various data shows that personalization does more than just nurture customer relationships; it boosts revenue across the customer lifecycle. It’s not surprising that the global personalization and optimization market is estimated to reach $11.6 billion by 2026.

Sales qualification during the buying process allows sales teams to make the sales process more finely targeted, addressing the pain points of the target audience and demonstrating value proposition. Without qualifying your prospects, you are at risk of investing in leads that are not a great fit for reasons such as lack of budget, poor timing or even internal leadership changes which can make decision making challenging for them in the short term. In terms of the buyer’s journey, qualification will happen towards the top of the funnel, allowing you to nurture unqualified leads (if they have a chance at being qualified down the road) so that you can focus on more likely buyer personas. Form-based qualification is effective in weeding out prospective customers who might not be ready yet, assessing the engagement of your existing customer base, and identifying new customers who meet your ICP, however it can be time consuming and relies on the cooperation of your leads. RevenueBase offers a short cut to qualification; with access to more than thirty buyer insights, you can quickly identify whether an account is qualified or not. In a nutshell, RevenueBase’s generative AI eliminates the need for form-based qualification, empowering sales teams to focus their time and energy on qualifying characteristics that aren’t easily determined by data, such as budget and timing.

For start-ups and organizations launching an entirely new product or service, it is not always possible to use your own data. The advantage of being a start-up is that you have the ability to be agile. Use that agility to test multiple audiences and rapidly assess and reiterate as you go. As you start to create demand, document your learnings; work out who is converting through your sales pipeline the quickest and identify the common characteristics.

When considering the ICP, it is tempting to stop at the basic firmographics: company revenue, geography, organization size, vertical. However, these linear measures alone could result in clunky results. At RevenuBase we have the technology to help you to delve beyond firmographics, accounting for technographics, qualifying characteristics, and readiness to buy so that we can build you an accurate, up to date and completely tailored ICP. What’s more, our service means that you can update your database regularly to give you up to the minute data. If a customer in your ICP changes roles or receives funding, we know that you want to know about it now, not in 6 months or even a year’s time.

Mark Feldman

2025/11/19

Mark Feldman

2025/11/03

Mark Feldman

2025/10/17

Mark Feldman

2025/10/05

Mark Feldman

2025/10/03

Mark Feldman

2025/09/28